State Bank of Pakistan adopts additional four new AAOIFI Shari’ah standards

This makes the total number of standards adopted by SBP 20

Manama, Kingdom of Bahrain: Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) is pleased to learn that the State Bank of Pakistan has adopted four additional AAOIFI Shari’ah standards. These standards include Shari’ah standard (SS) No. 10 – Salam and Parallel Salam, SS No. 11 – Istisna’a and Parallel Istisna’a, SS. No. 25 – Combination of Contracts and SS. No. 50 – Irrigation Partnership (Musaqat). This makes the total number of standards adopted by SBP 20.

On this occasion Mr. Omar Mustafa Ansari, Secretary General of AAOIFI commented “we are pleased to note that SBP has adopted four more AAOIFI Shari’ah standards for the Islamic banking and finance industry in the country. We believe harmonisation and standardisation of the industry and aligning with global standards will play an important role in achieving the strategic goals of SBP for the development of Islamic finance industry in line with the decision of Federal Shari’at Court of Pakistan”.

The Director of Islamic Banking Department (IBD), Mr. GM Abbasi commented “To further strengthen Shariah compliance regime, State Bank of Pakistan has adopted additional four AAOIFI Shariah Standards with certain clarifications/amendments. These include AAOIFI Shariah Standard No. 10 (Salam and Parallel Salam), No. 11 (Istisna’a and Parallel Istisna’a), No. 25 (Combination of Contracts) and No. 50 (Irrigation Partnership (Musaqat). With the adoption of these Standards, the total number of AAOIFI Shariah Standards adopted reaches to twenty whereas the remaining standards are in process of adoption. The initiative will help in harmonizing the Shariah practices in Islamic banking industry. Further, this adoption of the Standards is in addition to current regulations, other instructions and directives issued by SBP from time to time.”

Additionally, the Securities and Exchange Commission of Pakistan (SECP) has also adopted seven AAOIFI Shari’ah standards and have also issued directives of public consultation on seven additional Shari’ah standards. SECP has also joined AAOIFI as its institutional member in 2022 and there are ongoing discussions for further collaboration on areas of mutual interest.

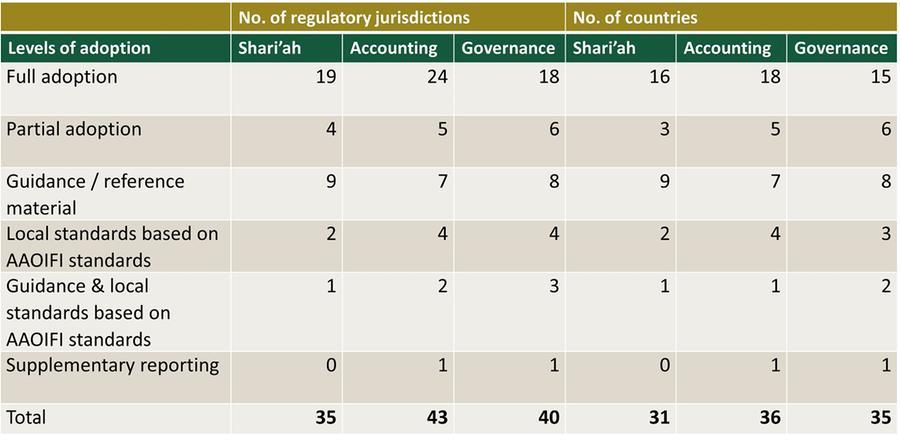

AAOIFI standards are now adopted in no less than 43 jurisdiction and 36 countries globally. This includes countries where AAOIFI standards are adopted / adapted fully / partially, as well as, those jurisdictions where local standards are based on AAOIFI standards or use them as guidelines to develop local standards. Additionally, there are jurisdictions where AAOIFI standards are adopted on a voluntary basis. Details of the adoption status in various countries is featured in AAOIFI Footprint Report, which can be accessed from: http://aaoifi.com/foot-print-report-download/?lang=en.

-Ends-

About AAOIFI

AAOIFI, established in 1991, and based in the Kingdom of Bahrain, is the leading international not-for-profit organization primarily responsible for development and issuance of standards for the global Islamic finance industry.

AAOIFI is supported by over 146* active institutional members, including central banks and regulatory authorities, financial institutions, accounting and auditing firms, and legal firms, from over 45* countries.

It has 117* standards and technical pronouncements in issue in the areas of Shari’ah, accounting, auditing, ethics and governance for international Islamic finance. 43* regulatory and supervisory authorities (RSAs) in 36* countries around the globe adopt and / or recognise AAOIFI standards and technical pronouncements either fully, partially, as guidelines, as supplementary reporting or as a basis of development of local standards / regulations.

* As of June 2022

For more information on AAOIFI its activities, please contact:

Dr. Rizwan Malik, Head, Standards Implementation and Strategic Developments, AAOIFI, e-mail: rmalik@aaoifi.com or rsas@aaoifi.com